2025 Washington State Legislative Session — Legislative Roundup!

By Mary Hull-Drury, Washington REALTORS® Director of Government Affairs

The 2025 Washington State Legislature completed its work on the last day of its 105-day session, April 27 at 6:31 pm. Lieutenant Governor Denny Heck (D) characterized this session as “grueling” and “brutal,” And we concur with the Lt. Gov’s assessment.

The brutality was due, in part, to the fact that legislators came into the 2025 session facing a $12-to-$20 billion budget deficit over the next four years – depending on how spending levels were calculated. The only two options to fix a budget deficit were to cut spending or raise revenue (aka new or increased taxes), and when facing a deficit of this magnitude it was likely both avenues were needed. The weight of this challenging situation affected nearly all legislative business conducted during the 105-day session. Below is a quick overview of the operating budget and the revenue package that ultimately passed.

Operating Budget

The $77.8 billion 2025-27 biennium operating budget was adopted on April 27th using a conference committee process. Overall, the 2025-27 biennium operating budget relies upon approximately $8.7 billion in new revenue over four years and includes $5.9 billion in funding cuts, as outlined in this The Olympian article.

Operating Budget Revenue Package

The 2025-27 operating budget relies upon a revenue package that is projected to generate $4.3 billion during the 2025-27 biennium and $4.4 billion during the 2027-29 biennium. Here is a list of bills/components of bills making up this revenue package.

ESHB 2081 – Business and Occupation Tax Increase

ESSB 5813 – Tax Rates/Capital Gains, Estate

ESSB 5814 – Excise Taxes / Sales Tax on Services

With a historic revenue shortfall needing to be addressed, the business community and the real estate industry entered the 2025 Legislative Session anticipating severe impact on businesses resulting from higher and new taxes. Additionally, there was an expectation that lawmakers in the majority would pursue policies that had the potential to negatively impact the real estate sector.

The following is an outline of Wins & Losses for the Real Estate Sector following the 2025 Legislative Session. In the end, while there were some clear defeats, the overwhelming sense is that the wins far outweighed the losses.

WINS

As noted above, there were significant efforts to increase the B&O tax rate for certain businesses (HB 2081) as well as to apply Sales Tax to a greater number of services (SB 5814). Due to extensive lobbying efforts by your team, neither of those two bills will directly impact brokerage services. Protecting your business from increased taxes was our top priority. As these two proposals made up the bulk of new revenues seeking to fill the historic budget shortfall, maintaining the status quo can only be seen as a massive win for the industry and its practitioners.

There was also a proposal that would have significantly impacted property taxes (HB 2049). Our Call to Action resulted in the highest number of constituent contacts opposing a bill in our state’s history. The bill that ultimately passed shifted focus away from increased property taxes and instead prioritizes education funding and revised guidelines for local school districts seeking to collect revenue from voter-approved local levies.

Furthermore, the historic $9 billion tax package does not include an increase in the real estate excise tax (REET), and the legislation raising the capital gains tax maintained the exclusion for gains from real estate transactions.

Supply

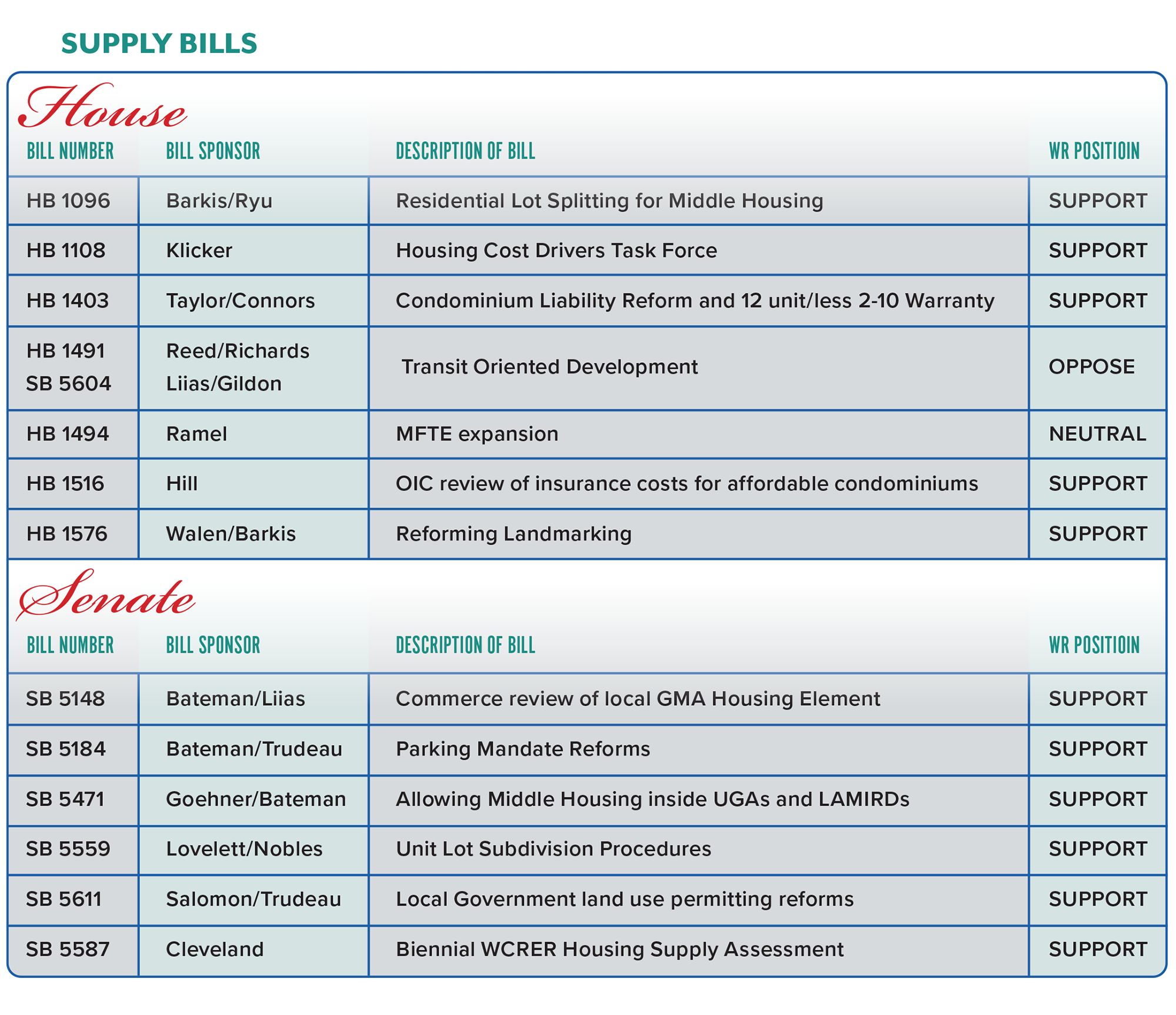

We also successfully passed a commendable package of housing supply policies as noted in this Washington Observer article, which included condo liability reform, lot splitting, minimum parking requirements, provisions for middle housing within UGAs and LAMIRDS (limited areas of more intense rural development), buyer waivers for resale certificates, and the establishment of a task force aimed at identifying housing cost drivers, among other initiatives. Here is a list of supply bills that are on their way to the Governor for signature:

LOSSES

Rent Control

The biggest loss this session was clearly the passage of statewide rent control (HB 1217). The majority party was clear from the outset that rent control was one of its top priorities for this session and that they believed they had the votes to pass it. Ultimately, the overwhelming majorities in both the House and Senate were too great to defeat the bill’s passage.

Despite the long odds, your lobbying team worked around the clock to minimize the bill’s impact. In the Senate we succeeded in gaining support for an amendment to exempt single-family homes from rent control and raised the annual rent cap to 10% plus CPI. Unfortunately, the House did not concur with the Senate's changes. When the House and Senate can’t reach agreement on a bill, it goes to a Conference Committee where 3 conferees from the House and 3 conferees from the Senate (2 Democrats and 1 Republican from each chamber) negotiate a new bill that goes before the House and Senate for an up or down vote. The Conference Report cannot be amended.

The Conference Committee on HB 1217 ultimately dialed back the amendments we fought to include in the Senate, removing the single-family exemption and lowering the cap rate to 7% plus CPI, capped at 10%. The Conference Report, which includes a chart of how the bill changed, can be found here.

Self-Storage

Another loss for a specific industry sector was in the passage of HB 5794. Beginning April 1, 2026, the rental or lease of individual self-storage space at self-storage facilities will be subject to B&O tax at the services and other activities classification at a rate of 1.5 or 1.75%.

Wrapping up & Looking ahead

Governor Ferguson will spend the next several days reviewing the budget proposal as explained in his statement about the 2025 Session. During this time period Governor Ferguson can either sign or veto bills, and also note that bills that are delivered fewer than five days before the Legislature adjourns have 20 days to be acted on by the governor (see this Bill Action FAQ page for more information).

Given the inevitability of new and higher taxes, as the dust settles on the 2025 Legislative Session the real estate industry should feel that it came out with more wins than losses. Of course, we prefer that rent control did not pass, but that we avoided impactful taxes is a big win given the large revenue shortfall. That being said, I want to strongly caution readers that it would be premature, and to our own detriment, to celebrate just yet since there are rumors already spreading of a special session later this year to address ongoing revenue shortfalls. So while we have fought many great battles this session, the fight continues!