Market RE/Search: Summer 2025 Market Statistics

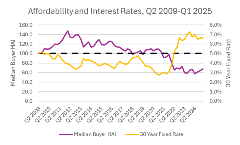

As shown in the accompanying chart, affordability for the median home buyer in Washington State (on the lefthand axis) is closely related to mortgage interest rates (on the righthand axis). Indeed, the two data series are virtually mirror images: when interest rates go down, affordability improves, and when interest rates go up, affordability deteriorates. The median-priced house is affordable when the index is 100 or greater and unaffordable when it is less than 100.

The Washington Center for Real Estate Research calculates housing affordability indexes (HAIs) for hypothetical buyers and renters each quarter. The median-income buyer HAI calculates the affordability of a median-priced single-family house as reported in our quarterly Housing Market Reports. This HAI assumes that the household can pay a 20% down payment and that the balance of the cost of the house is paid for with a 30-year fixed rate mortgage using the quarterly average interest rate (based on data published by Freddie Mac).

WCRER estimates median household income using data from the Washington State Office of Financial Management and the U.S. Bureau of Labor Statistics. (Note that the income data are updated as better data become available, resulting in small changes to our affordability measures.) The affordability index assumes that households can afford to spend 30% of their income on mortgage payments. The index is calculated by dividing 30% of the median annual income by total annual mortgage payments. If 30% of the median income is exactly enough to cover the mortgage payments, then the HAI equals 100 (shown by the dashed line). If 30% of median income is more than enough to cover the mortgage payment, then the HAI will be greater than 100; if 30% of median income is not enough to cover the payment, then the HAI will be less than 100.

For most of the 16-year period shown in the chart, the median-priced house in Washington was affordable for the median-income household. Starting at the end of 2021, interest rates began to rise sharply, while affordability dropped equally sharply. By the third quarter of 2022, interest rates were well above 6% and they have remained elevated since. At the same time, the median-income buyer HAI has stayed well below 100.

As discussed in previous market commentary, high interest rates have placed a damper on both demand and supply in the single-family market. Potential buyers find it harder to qualify for a mortgage loan, while potential sellers do not want to give up their low-interest rate mortgages. This situation has been aggravated by higher construction costs that affect the prices of both new and existing houses. While the supply side of the market has loosened up a bit recently, the demand side remains weak, meaning that the number of transactions is relatively low. This scenario seems likely to continue for the foreseeable future.

Steven C. Bourassa, Ph.D.

Director of the Washington Center for Real Estate Research

Runstad Department of Real Estate

University of Washington | wcrer@uw.edu