Fall 2025 - Market Statistics - Construction Costs and the Housing Market

FALL 2025 Market Statistics • College of Built Environments • University of Washington

Construction Costs and the Housing Market

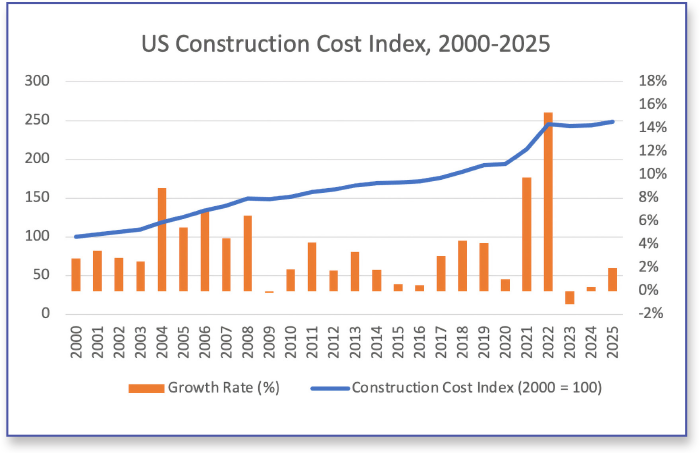

Construction costs increased sharply in 2021 and 2022 due in part to supply chain problems caused by the COVID-19 pandemic. A spike in household formation and housing development also played a role by increasing the demand for construction labor and materials. As shown in the chart, construction costs grew at rates in 2021 and 2022 that far exceeded their recent averages (the cost index is from RS Means). Since then, they have grown slowly, even declining by over 1% in 2023. In fact, construction costs today are just about where they would have been had they increased in a linear manner over the 2000-2025 period shown.

Earlier this year, proposals for new tariffs affecting the cost of construction materials combined with more rigorous controls on immigration led to dire predictions about further increases. One study, published in April in The New York Times, estimated that a particular high-end home in Phoenix would cost 18% more to build because of proposed tariffs and immigration constraints. Yet we have not seen any evidence of this to date.

Construction costs are important because they affect the cost and viability of new development, as well as the affordability of existing homes and apartments. Higher construction costs may cause proposed new developments to fail to pencil out, and they may make new homes too expensive for prospective buyers. But they also affect the values of existing buildings, which are determined by depreciated replacement costs. Replacement costs are themselves a function of current construction costs.

Part of the reason we have not seen higher construction costs is reduced construction activity, driven largely by high interest rates and lack of effective demand. Concern about potential construction costs may also be deterring some development. Residential construction in Washington state reached a peak of nearly 57,000 units in 2021, rising from less than 34,000 as recently as 2014. This declined to about 37,500 units last year and is on track to be even lower this year. Significantly reduced demand for construction labor and materials is helping to temper increases in costs that might otherwise occur. If development activity picks up again, perhaps in response to reduced interest rates, we may well see some of the savings from lower financing costs eaten up by higher construction costs.

About the Author

Steven C. Bourassa, Ph.D. is the Director of the Washington Center for Real Estate Research, Runstad Department of Real Estate.

University of Washington | wcrer@uw.edu

RE Magazine Fall 2025 Digital Issue

Articles

- Message From The President

- Market Statistics — Construction Costs & the Housing Market

- WASHINGTON REALTOR® Profile: Brooks Glenn

- Legal Hotline: WUCIOA — What Is It & Why Do I Care?

- Property Management Q&A — Lease Renewal Notice

- Selling Safely: Agent Self-Defense in 3D!

- We Give a &!#% About Your Success

- Designation Spotlight, MRP: Rich Jacobson